It is no secret that mobile apps have become our saviors especially during the time of quarantine. From mobile games to entertainment apps, consumers can’t get enough of their favorite apps. According to Sensor Tower’s latest report, global spending on mobile apps will reach $270 billion by 2025. The App Store will account for $185 billion at an annual growth rate of 20.7%, while Google Play will reach $85 billion with 16.9% annual growth over the next five years.

Get all the details on the Mobile Market Forecast including forecasts for revenue and download, the top regions, top countries, and top categories in this report recap!

Global App Downloads Expected to Reach 270B by 2025

Global consumer spending in mobile apps is projected to reach $270 billion by 2025, nearly 2.5 times the $111 billion from 2020. App Store spending is expected to reach $185B, while spend on Google Play revenue is expected to hit $85B. Growth is expected to be strong on both stores, with a compound annual growth rate (CAGR) of 21% on the App Store and 17% on Google Play over the next five years.

According to Sensor Tower, the spread of COVID-19 in 2020 did little to dampen mobile user spending. Growth accelerated in 2020, with user spending surging 30% year-over-year to $111 billion in 2020 (compared to 21% Y/Y growth in 2019). The mobile app space has proven itself to be resistant to many major market shifts, and as a result, it is projected to have continued stable growth.

Europe Is The Key Region To Watch Over The Next Five Years

Europe’s project revenue growth is higher than that in North America and Asia, with an expected CAGR of 23% over the next five years in Europe compared to 20% in Asia and 18% in North America. User spend in Europe will reach $42 billion by 2025 as a result.

Meanwhile, download growth over the next five years will be driven by Asia. The region will surpass 100 billion downloads on Google Play by 2025, with India accounting for more than half of these downloads. After download growth in India stalled in 2019, app adoption increased following the spread of COVID-19 in 2020. While growth is expected to decline again over the next few years, India is projected to surpass 60 billion downloads in 2025, growing more than 15x over the 10 years between 2015 and 2025.

Other top markets like Indonesia, Vietnam, and Pakistan will also contribute to the region’s success. There is quite a bit of variance between the forecasts for top Asian markets. China, Japan, and South Korea are projected for growth between 0 and 15% between 2020 and 2025, while other markets such as Indonesia, Vietnam, Pakistan, and the Philippines will see downloads approximately double over the same period.

China Expected to Be the Top App Store Country in 2025

When the Sensor Tower analyzed the App Store specifically, China, the U.S., and Japan are all projected to surpass $28 billion in consumer spending by 2025 according to. While government regulation has had an impact on China’s app downloads, revenue growth has remained strong. China’s user spend on the App Store is expected to approach $55 billion by 2025, with a CAGR of 22%. China is expected to edge out the U.S. that year, but the two countries will have similar trajectories over the next five years. While it is expected there will be some change to the order of countries ranked between five and 10, the group will remain closely matched. Canada is projected to be the No.5 country in 2025 at $3.7 billion, while France will rank No.10 at $2.5 billion.

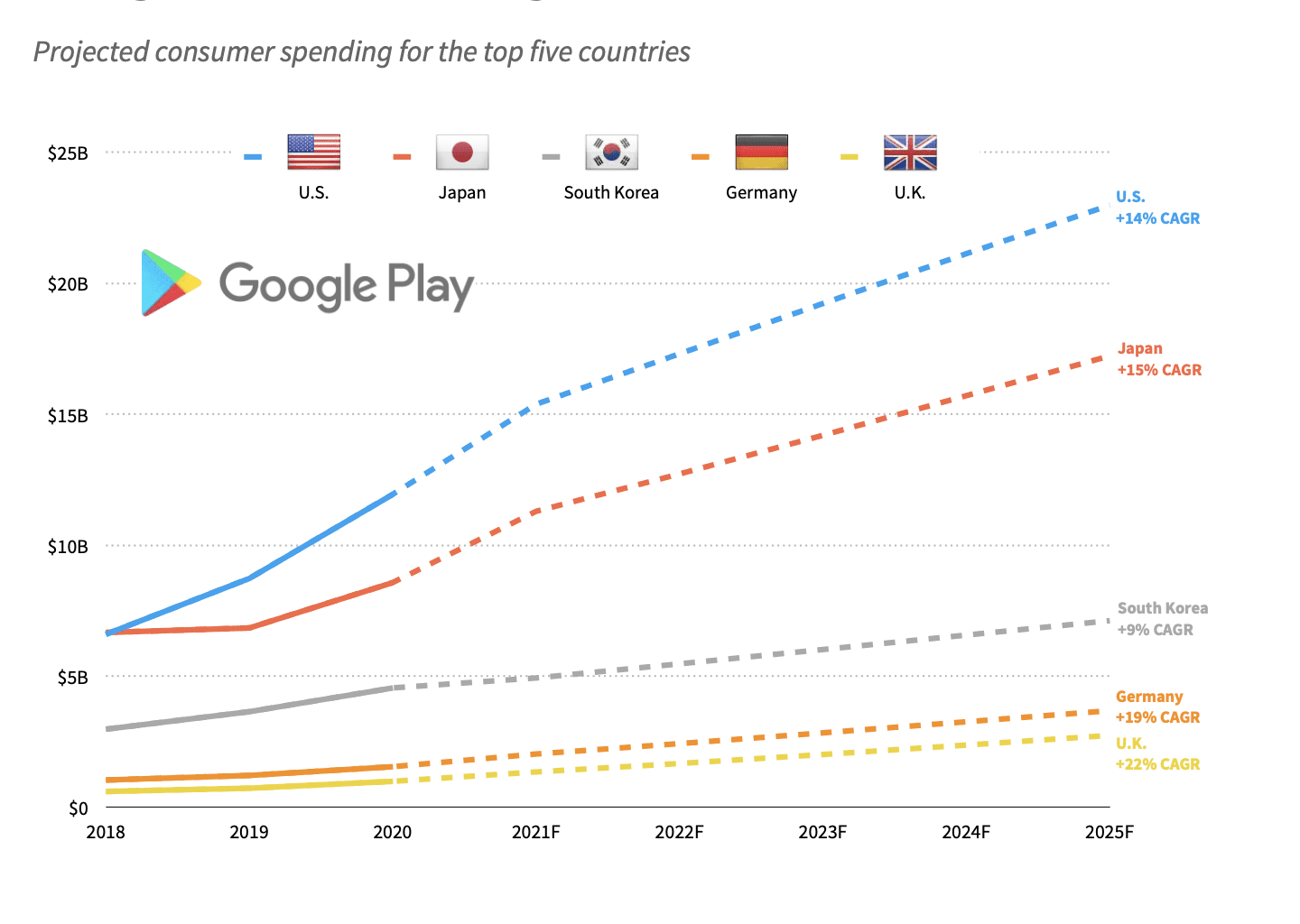

Google Play revenue growth in the U.S. and Japan accelerated in 2020. In the U.S., growth increased following the spread of COVID-19, particularly among games. Spending in mobile games is expected to remain high in 2021 as consumers continue to spend more time at home during COVID-19. Among the top five countries, the U.K. has the highest projected revenue CAGR at 22%, followed by Germany at 19%. The top Asian countries, Japan and South Korea are projected for lower growth.

After U.S. downloads on Google Play peaked at nearly 5.8 billion in 2016, installs decreased year-over-year for three consecutive years. Buoyed by COVID-19, downloads bounced back in 2020 to nearly reach the peak seen in 2016. A modest CAGR of 2% is projected for the next five years. Pakistan, Vietnam, and Mexico are projected for strong growth over the next five years. These countries will join the U.S. at approximately 6 billion downloads in 2025.

India will continue to dominate the Google Play market, approaching 60 billion annual downloads by 2025. The forecast of 18% CAGR for the next five years is substantially lower than the 49% CAGR India achieved over the previous five years, but the growth rate has shown signs of slowing even before the arrival of COVID-19. Indonesia surpassed the U.S. in 2019 and expanded its lead to more than 1 billion by 2020. Indonesia is expected to have more than twice as many installs than the U.S. in 2025.

Games vs. Apps

The outbreak of COVID-19 caused a massive surge of app adoption as consumers adjusted to stay-at-home life. Business, Education, Medical, and Health & Fitness downloads all spiked in the spring of 2020. Games also saw an initial spike in downloads, but a dip in hypercasual game adoption offset this later in the year. Meanwhile, Travel and Navigation both saw substantial declines while consumers remained at home. Sports installs also fell as games were cancelled or postponed, but downloads returned when play resumed during the summer and fall.

About the Report

Sensor Tower’s 2021-2025 Mobile Market Forecast report offers a look ahead at consumer spending and downloads on the App Store and Google Play. Discover how COVID-19 reshaped the mobile app ecosystem and the lasting impact it made on 2021 and beyond. For more trends and forecasts, download Sensor Tower’s full report.

Join the Conversation

What do you think about this mobile market forecast? Tweet us @AdColony. For the latest AdColony mobile news and updates, follow @AdColony on Twitter, like us on Facebook, or connect on Linkedin.

- Creative Showcase: More Cravings by Marriott Bonvoy - June 2, 2022

- Creative Showcase: Ford Stormtrak & Raptor - May 5, 2022

- Creative Showcase: Nespresso - January 27, 2022